Typically, stock trades are computerized, whereas something like actual property requires a more personal touch. This conduct commonplace is different from the principles for financial advisors regulated by the SEC as registered funding advisors (RIAs). Under the Funding Advisers Act of 1940, RIAs are held to a strict fiduciary normal to at all times act in the best curiosity of the shopper, while offering full disclosure of their charges. These Days, it is straightforward to avail brokerage providers on-line utilizing web sites and cellular apps. Sustainable and socially accountable investing, also referred to as https://www.xcritical.com/ environmental, social, and governance (ESG), is another growing development in the brokerage industry.

That said, it could be a good idea to perform a little analysis brokerage as a service before signing up. How much you should begin investing with a broker depends on the precise dealer or brokerage. Some might not have minimal quantities, while others may have comparatively massive or high balance requirements.

- That is, they are ready to provide a serving to hand at times, which can be worthwhile to new or starting investors who’re still getting their sea legs.

- Robo-advisors use laptop packages to determine on and handle your investments based in your targets and timeline.

- They present individual assistance to purchasers in selecting optimal lending options.

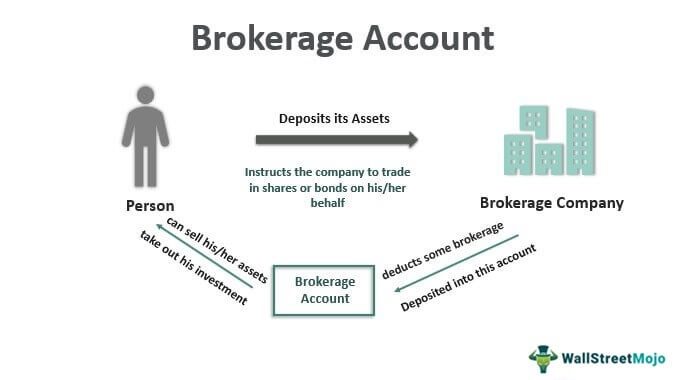

Investopedia frequently reviews all the highest brokers and maintains a list of one of the best on-line brokers and buying and selling platforms to assist buyers determine what broker is greatest for them. Brokerages focus totally on funding providers, offering tools to purchase and promote securities, whereas banks provide monetary providers like savings accounts, loans, and credit score. Depending in your goals, a brokerage is healthier for funding, while a bank is better for managing everyday finances. A brokerage is a financial agency that facilitates the buying and promoting securities like shares, bonds, and ETFs. Shares, however, are individual shares or units of possession in a company.

Constancy Investments

More traders want to align their investments with their values by supporting firms focusing on sustainability, ethical practices, and social duty. Brokerage companies are regulated by numerous bodies to guarantee that they function fairly, transparently, and securely. These rules are in place to protect traders and preserve the integrity of the financial markets.

How Much Money Do I Would Like To Begin Investing With A Broker?

These brokers enchantment to younger traders who prefer managing their investments from smartphones or computers. They usually offer a extensive range of investment choices, from shares to cryptocurrencies, and provide quick, handy market entry without needing in-person meetings or advanced procedures. Vanguard is best recognized for its low-cost investment choices, particularly index funds and ETFs. The company presents commission-free buying and selling on Vanguard ETFs and a selection of different investment options, making it a top choice for long-term buyers. Vanguard is popular amongst investors who want to construct a diversified portfolio and minimise fees.

If you are new to investing, it’s advisable to be extra cautious when using leverage. A margin account permits you to borrow extra funds from your broker. The broker acts as a lender, and the borrowed funds permit for larger and more advanced Payment gateway trades, similar to quick promoting.

Finest Investing Tools

Like Charles Schwab, Constancy presents commission-free trades on stocks and ETFs and has a robust research platform. Constancy is especially popular for retirement savings, with various retirement accounts like IRAs and 401(k) plans. The firm additionally presents wealth management providers for people who desire a extra hands-off strategy to investing. The brokerage firm takes care of the buying and promoting for you and charges a small payment for these providers. They give advice on investments, assist you to plan for taxes and retirement, and ensure you have quite a lot of funding options. Brokerage accounts hold securities such as shares, bonds, and mutual funds, in addition to any unused cash, and are used for funding functions.

You can pull your cash out anytime, for any cause, and invest as a lot as you’d like. Once you have opened and funded your account, you may be questioning how to … Which investments you choose will depend on the type of account you opened, your risk tolerance, your timeline and your investing objectives. The type of brokerage account provider you select largely depends on whether or not you wish to handle your own investments or gain access to assist. Some brokers make you confirm a transaction earlier than you’ll find a way to start purchasing investments. If that’s the case, you’ll have to attend until the dealer deposits a small sum in your checking account — typically a few cents.

How Brokers Are Regulated In Monetary Markets

In reality, after Robinhood pioneered commission-free inventory and ETF buying and selling, most online brokers adopted go properly with and now permit users to purchase and promote stocks, ETFs, and, in some circumstances, choices free of charge. Most on-line brokers still charge fees for entry to extra complex instruments, like futures, or more exotic property, like cryptocurrencies. In the monetary securities business, a brokerage charge is charged to facilitate trading, manage funding accounts, or provide numerous other companies. The three primary kinds of brokers that cost brokerage fees are full-service brokers, on-line brokers, and robo-advisors. Investors use brokerage corporations for their experience, access to monetary markets and the comfort they supply in managing investments. Brokerage account sorts differ to cater to completely different investor wants and preferences.